Corporate Bond

USA Attorneys Office

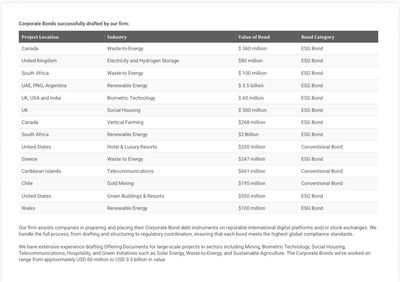

Our firm assists companies in preparing and placing their Corporate Bond debt instruments on reputable international digital platforms and/or stock exchanges. We handle the full process, from drafting and structuring to regulatory coordination, ensuring that each bond meets the highest global compliance standards.

We have extensive experience drafting Offering Documents for large-scale projects in sectors including Mining, Biometric Technology, Social Housing, Telecommunications, Hospitality, and Green Initiatives such as Solar Energy, Waste-to-Energy, and Sustainable Agriculture. The Corporate Bonds we've worked on range from approximately USD 60 million to USD 3.5 billion in value.

CORPORATE BOND ISSUANCE PROGRAMME

We are in a position to offer our clients the opportunity to raise finance through the issuance of a Corporate Bond.

This corporate bond programme has been structured to provide efficient, large-scale funding for qualifying projects.

The structure allows for flexibility, global applicability, and full project funding without equity dilution.

Key Features

Legal & Structuring

Corporate bonds are drafted by experienced corporate lawyers within our global network based in

London (UK), Chicago (US) and Cape Town (SA)

Bond Size

• Minimum bond value: USD 10 million

• Maximum bond value: USD 1 billion

Geographic Scope

Projects may be located globally subject to international compliance, sanctions, and regulatory

requirements.

Project Profile

Proven borrowers who can demonstrate a track record of completing projects and or profitable ventures.

Funding Structure

• Up to 100% project funding

• No profit share required

• Bond term of 5 to 10 years

• Fixed interest rate of 6% per annum

Drawdown Flexibility

Part-funding drawdowns are available (Example: A USD 200 million bond may be structured into 10

tranches of USD 20 million, allowing staged capital deployment)

Bond Listing Options

The bond may be issued on Bloomberg or listed on one of the following exchanges:

• Nasdaq

• London Stock Exchange

• Euronext

• The International Stock Exchange (TISE)

• Vienna Stock Exchange

CORPORATE BONDS IN BRIEF CONTEXT

The important point to understand is that each bond is unique and the success of one bond has no real relevance to another, as they are targeting investors worldwide, who will each have their own criteria - unlike lenders who all have similar lending appetite.

Corporate Bonds have seen significant growth as a vehicle for raising capital for international projects

over the last decade.

To fully illustrate the significance of the context, below are the values of Global Sustainable Bond Issuances per annum, from the years 2010 to 2023:

2010: $4 billion

2015: $42 billion

2020: $309 billion

2023: $588 billion

There has been a dramatic increase, exceeding USD500 billion.

Process

If you wish to proceed with the Bond, we would request a summary report and proposal. This will be presented to the board for approval. Upon approval, you will have a call with the attorneys to discuss the matter further.

Timeline

Drafting and issuance may take up to 10 weeks, particularly where a third-party opinion is required

Professional & Listing Fees

* No Upfront Broker Fee

* Client will meet lawyers for due diligence before any formal offerings

• Mandated legal counsel: USD 45,000

• ESG third-party opinion (if required): USD 40,000

• Listing fees: USD 20,000

Please note: The mandated legal fees of $45,000 have to be paid 50% on instruction to the lawyers to act and the balance in stage release whilst the lawyers are working with the client to create the bond for listing. The listing fees are payable to the listing agency such as Bloomberg. There is a fee payable to the lawyer to prepare the investment document to be listed on Bloomberg etc.

Investment Sourcing

• 2% fee applies where investment capital is sourced via a broker clearing house

• Where investors engage directly with the client, only legal fees apply

Our Fees

Our office fee ranges between 2% and 3%, subject to the parties and structure involved.

Stage One: To enable the attorney to take on a mandate, they will require the following:

1. The name and registration number of the entity that will be issuing the corporate bond;

2. The full name and designation of the company representative, representing the company and signing of their mandate;

3. The physical address of the company;

4. The face value (monetary size) of the bond that the company will be issuing.

Stage Two: For the execution of the mandate, the attorney will require the following:

5. It is ideal if the client can provide a “pitch deck” which will be used to kick off discussions and questions; Inside the pitch deck or executive summary, the attorney would like to establish:

5.1 Does the company have a track record in the industry? Is there a proof of concept?

5.2 What is the extent to which they will be able to provide collateral?

5.3 Is it clear that the company has the requisite experience and expertise?

5.4 Have all compliance issues already been addressed? In the case of a bond for property, we will look at whether the site(s) have been identified, as well as the requirements for - an environmental impact study, rezoning, subdivision, planning permissions, building plan approvals etc. These are all issues which may potentially delay the commencement of a project.

5.5 What is the market analysis for the product? Are there off-take agreements or letters of interest?

5.6 We scrutinise the financials for the project. What are the bond funds going to be spent on? How long will it take to create a revenue stream? How many revenue streams are envisaged? Will the revenue streams be able to service the interest and return the capital upon the maturity of the bond?

The attorney will provide the client with their Business Plan or Executive Summary Headers immediately upon the signature of their mandate, which will assist them in collating and presenting the necessary information.

In the introduction to the client, it is useful if the issuer has had sight of the questions above. The aforegoing is not an exhaustive list, but these questions may serve as a very useful point of start. The main initial objective is to quickly establish whether the project is viable for the bond market.

For example, if it is established that there are too many compliance issues which are outstanding, it might be that the client will first have to address these before embarking upon the process of drafting and issuing a bond. In our experience, however, eight out of ten clients are ready for the bond market.

1st week - STEP BY STEP GUIDE TO THE ISSUING OF A BOND

The first step is for the client to sign the attorney’s mandate and Power of Attorney, authorising the attorney to commence the drafting of the Bond. Once they have a signed mandate and they have received 50% of the fee the process commences:

The attorney conducts due diligence on the client as part of their KYC / AML protocols.

The attorney will provide the client with their comprehensive Business Plan Headers

document, which will assist the client in realigning their current Business Plan/Executive Summary with the Bond market.

2nd to 5th week

The duration of this phase is largely in the client’s hands. During this phase, the client is required to align their Executive Summary (Business Plan) with the Bond market under the attorney's guidance.

The attorney will analyse the Executive Summary generated by the client and will give feedback on how it may be improved. It is vital that the culmination of both the financial and substantive (technical) elements of the Executive Summary is both defendable and marketable.

*It is important to note that the phase described above is predominantly in the hands of the client, due to the fact that the client’s technical and financial personnel are required to provide comprehensive information for the completion of the project’s Executive Summary. For the purpose of this step-by-step guide, 4 weeks have been allocated for a client to complete their Executive Summary. In practice, clients have taken anywhere between 2 weeks and 4 months to complete their Executive Summary, depending on how close they were to readiness at the inception of this process.

6th to 10th Week

The drafting of the Trust Indenture and the Use of Proceeds/Listing Particulars is commenced (these documents comprise the official Corporate Bond documentation).

The client’s Executive Summary is incorporated into the Listing Particulars.

Establishing, coordinating, drafting, and settling the full pack of official Corporate Bond documentation.

Analysis of the financial component of the Use of Proceeds by the attorney’s Forensic Accountant. This generally entails many exchanges between our Accountant and the client’s financial team.

Application for the LEI code (Legal Entity Identifier).

Application for the ISIN number (International Securities Identification Number).

After approximately 8 to 10 weeks, the client can expect to have a Corporate Bond which is ready for market, subject to the qualifier above*. The Bond can be taken to market through distribution to networks and broker-agents, and by listing the Bond on stock exchanges and/or electronic platforms. The attorney offers assistance with listing or placement of Bonds on stock exchanges and electronic platforms.

Provided that there are no amendments required to be made to the Bond documents, the Bond drafting process is completed at this point (after approximately 8 to 10 weeks), and the Bond may be taken to market.

The process, however, continues in parallel in the case of Sustainable Bonds.

In the case of Sustainable Bonds

Please note that the marketing of the Bond may commence immediately after the drafting process described above, even though the ESG (Environmental, Social and Governance criteria) verification is still required.

If a Bond is eligible for ESG verification, the attorney offers the service of drafting and providing a Sustainable Bond Framework, which takes approximately 2 weeks. The cost of the Framework is quoted separately from the attorney’s Bond drafting fee.

The completed Corporate Bond documentation and the Sustainable Bond Framework are allocated

to an independent international verifier to draft the Second Party Opinion. This process takes

approximately 6 to 8 weeks, depending upon the complexity of the Bond. The cost of obtaining the

SPO is separate from the cost of drafting the Bond. This cost is due directly to the third-party verifier.

The final stage of the ESG process is optional, depending solely on the client’s requirements. ClimateBond Initiative or “CBI certification” is the apex of ESG certification, which certifies that a Bond or entity meets its specific, science-based Climate Bonds Standard. The cost of this process is due directly to CBI and is not included in the attorney drafting cost. The attorney’s mandate contains all of the terms and conditions of their engagement with the client for the purpose of draft in the corporate bond.

We have regulated offices and representatives in London, New York, Florida, Chicago, Ohio, Madrid, Rome, Antwerp, Vienna, Monaco, Tel Aviv and Switzerland.

Copyright © 1979-2026 - GS Corporate Finance - All Rights Reserved

Powered by WPP PLC